Rory

Closed Account

I believe this counts as pseudoscience.

The Economic Forecast Agency (EFA) claims to use "reliable models for long-term forecasting" of various financial markets with the implication being that these models provide "accurate forecasts":

source: https://longforecast.com/

Given the unpredictable nature of financial markets and exchange rates it seems a bold and dubious claim and I decided to put it to the test by seeing how they've done historically on certain currency exchanges.

(I didn't see any historical data or measures on their site but luckily the urls for the various markets are still the same as they were five years ago and so everything needed can be found at archive.org)

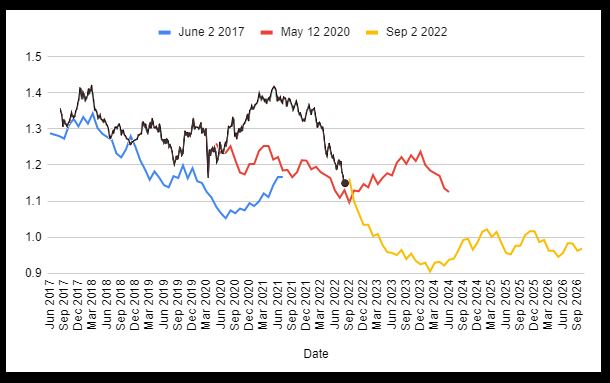

Here's GBP to USD:

The black line is what actually happened while the other three are the "long-term forecasts" made as of the dates in the legend. As we can see there's no real correlation - other than, I would say, can be expected by chance and/or our tendency to seek patterns - and their predictions change substantially from one to the next (nothing intrinsically wrong with that, but it does support the idea that its being "made up as it goes").

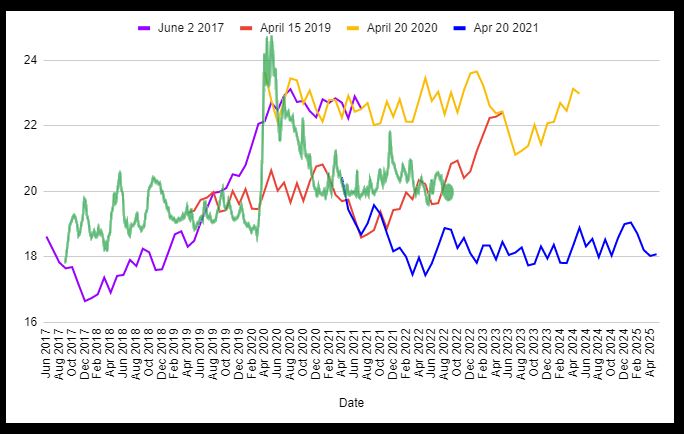

Next USD to MXN:

As above, 'cept the green line is the true historical data, and again it's difficult to see any kind of "success". Following the purple line (2017 prediction) it does appear as though reality 'catches up' around April 2020 and there's a somewhat similar trend in both sets of data - but, then again, they quickly diverge and, in any case, it appears that the model had already "changed its mind" by then - going by the 2019/red line - and was predicting something quite different.

And, of course, given the relative high of April 2020 the model (yellow line) then predicts it will mostly stay around there - pretty much always beween 22 and 24 - whereas in reality it dropped back down to 20 and rarely peeked above 21.

Furthermore, because of this drop, the model in April 2021 (blue line) continues the trend of a fall - predicting lows under 18 and an average under 19 - which again missed the mark.

It's almost as if it's solely basing it on what's come before and any correlations are pure luck.

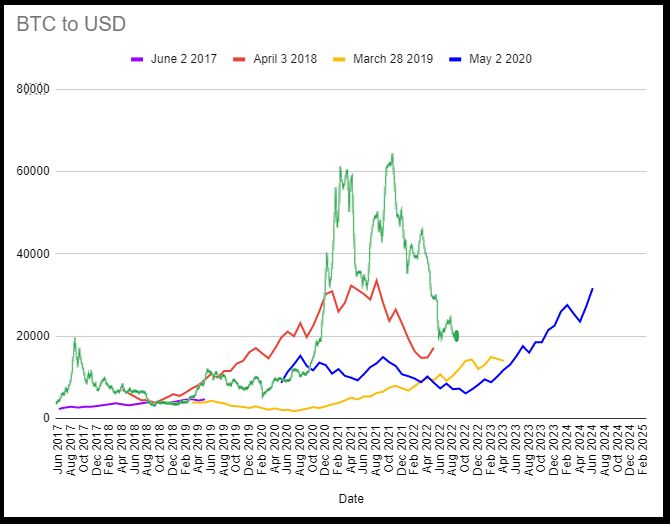

Even more illustrative, here's BTC to USD:

Green line is reality and, again, as far as I can see - chance and apophenia excepting - it completely misses the mark.

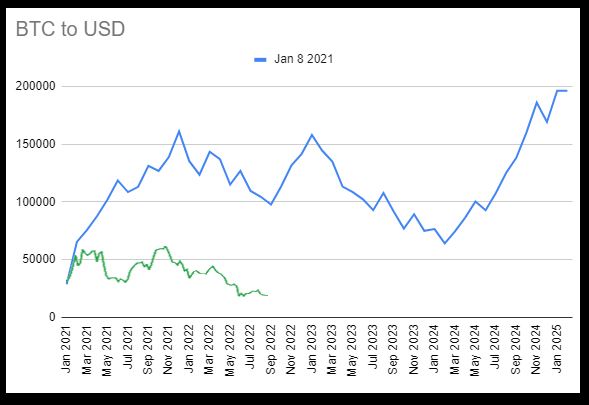

Finally, here's their January 2021 prediction for what bitcoin would do:

It was so far off base - made when bitcoin was on the rise, and predicting that we would have seen $150,000 by now - that it wouldn't fit on the scale of the previous chart without rendering everything else illegible.

So though not a complete study of the full range of markets I feel fairly confident that their prediction model fails the test and confirms what we all probably suspected: that it would be lovely if financial markets were predictable but, sadly, they're not.

Question is: what are they getting out of this? Can they be making money? Is it some sort of scam? Or just a simple model that puts some figures on a website every month for reasons unknown?

The Economic Forecast Agency (EFA) claims to use "reliable models for long-term forecasting" of various financial markets with the implication being that these models provide "accurate forecasts":

source: https://longforecast.com/

Given the unpredictable nature of financial markets and exchange rates it seems a bold and dubious claim and I decided to put it to the test by seeing how they've done historically on certain currency exchanges.

(I didn't see any historical data or measures on their site but luckily the urls for the various markets are still the same as they were five years ago and so everything needed can be found at archive.org)

Here's GBP to USD:

The black line is what actually happened while the other three are the "long-term forecasts" made as of the dates in the legend. As we can see there's no real correlation - other than, I would say, can be expected by chance and/or our tendency to seek patterns - and their predictions change substantially from one to the next (nothing intrinsically wrong with that, but it does support the idea that its being "made up as it goes").

Next USD to MXN:

As above, 'cept the green line is the true historical data, and again it's difficult to see any kind of "success". Following the purple line (2017 prediction) it does appear as though reality 'catches up' around April 2020 and there's a somewhat similar trend in both sets of data - but, then again, they quickly diverge and, in any case, it appears that the model had already "changed its mind" by then - going by the 2019/red line - and was predicting something quite different.

And, of course, given the relative high of April 2020 the model (yellow line) then predicts it will mostly stay around there - pretty much always beween 22 and 24 - whereas in reality it dropped back down to 20 and rarely peeked above 21.

Furthermore, because of this drop, the model in April 2021 (blue line) continues the trend of a fall - predicting lows under 18 and an average under 19 - which again missed the mark.

It's almost as if it's solely basing it on what's come before and any correlations are pure luck.

Even more illustrative, here's BTC to USD:

Green line is reality and, again, as far as I can see - chance and apophenia excepting - it completely misses the mark.

Finally, here's their January 2021 prediction for what bitcoin would do:

It was so far off base - made when bitcoin was on the rise, and predicting that we would have seen $150,000 by now - that it wouldn't fit on the scale of the previous chart without rendering everything else illegible.

So though not a complete study of the full range of markets I feel fairly confident that their prediction model fails the test and confirms what we all probably suspected: that it would be lovely if financial markets were predictable but, sadly, they're not.

Question is: what are they getting out of this? Can they be making money? Is it some sort of scam? Or just a simple model that puts some figures on a website every month for reasons unknown?

Last edited:

at the bottom/top of the screen. Select Add to Home, Add.

at the bottom/top of the screen. Select Add to Home, Add. at the bottom/top of the screen. Select Add to Home screen.

at the bottom/top of the screen. Select Add to Home screen. the screen.

the screen.