MikeG

Senior Member.

As part of his Geoengineering Watch Global Alert News for November 14th, Dane Wigington forecasted the collapse of the world economy.

http://www.geoengineeringwatch.org/geoengineering-watch-global-alert-news-november-14-2015/

http://abc.az/eng/news_07_11_2015_92011.html

https://en.wikipedia.org/wiki/Baltic_Dry_Index

https://en.wikipedia.org/wiki/Baltic_Dry_Index

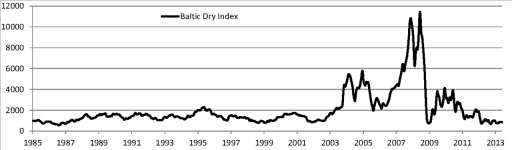

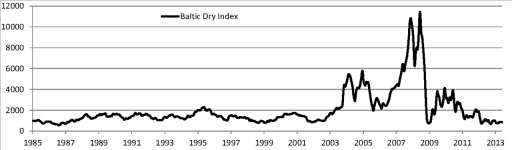

Although it has significantly declined very recently, historical context is important for the sake of a better perspective on the BDI's value.

http://www.geoengineeringwatch.org/geoengineering-watch-global-alert-news-november-14-2015/

His source was a website, ACB.AZ which cites another website, Zero Hedge.External Quote:The global economy is free falling into total collapse. Not only is every form of US freight screeching to a halt, the global dry freight index (BDI) is at all time record low levels (the BDI is the most untarnished economic barometer on the planet).

http://abc.az/eng/news_07_11_2015_92011.html

Wigington's reliance on the Baltic Dry Index (BDI) to make his point caught my attentionExternal Quote:Baku, Fineko/abc.az. The collapse of the global trade is already visible in the details: Baltic Dry Index (BDY) fell to the lowest level in its history.

U.S. website Zero Hedge says that BDY at a level of 631 is the lowest cost for Baltic Dry Freight Index for this time of year in history and a small drop of an all-time historical low.

Wikipedia gives some interesting perspective on the Baltic Dry Index:External Quote:(the BDI is the most untarnished economic barometer on the planet).

https://en.wikipedia.org/wiki/Baltic_Dry_Index

Fluctuations within this "inelastic" system are fairly routine.External Quote:The supply of cargo ships is generally both tight and inelastic—it takes two years to build a new ship, and the cost of laying up a ship is too high to take out of trade for short intervals,[6] the way you might park a car safely over the winter. So, marginal increases in demand can push the index higher quickly, and marginal demand decreases can cause the index to fall rapidly. e.g. "if you have 100 ships competing for 99 cargoes, rates go down, whereas if you've 99 ships competing for 100 cargoes, rates go up. In other words, small fleet changes and logistical matters can crash rates..."[7] The index indirectly measures global supply and demand for the commodities shipped aboard dry bulk carriers, such as building materials, coal, metallic ores, and grains.

Because dry bulk primarily consists of materials that function as raw material inputs to the production of intermediate or finished goods, such as concrete, electricity, steel, and food; the index is also seen as an efficient economic indicator of future economic growth and production. The BDI is termed a leading economic indicator because it predicts future economic activity.[8]

The point is that, although the BDI is a leading economic indicator, it is obviously not the only one and subject to important variables that Wigington either ignored or misread.External Quote:On 20 May 2008, the index reached its record high level since its introduction in 1985, reaching 11,793 points. Half a year later, on 5 December 2008, the index had dropped by 94%, to 663 points, the lowest since 1986;[12] though by 4 February 2009 it had recovered a little lost ground, back to 1,316.[13] These low rates moved dangerously close to the combined operating costs of vessels, fuel, and crews.[14][15]

https://en.wikipedia.org/wiki/Baltic_Dry_Index

Although it has significantly declined very recently, historical context is important for the sake of a better perspective on the BDI's value.