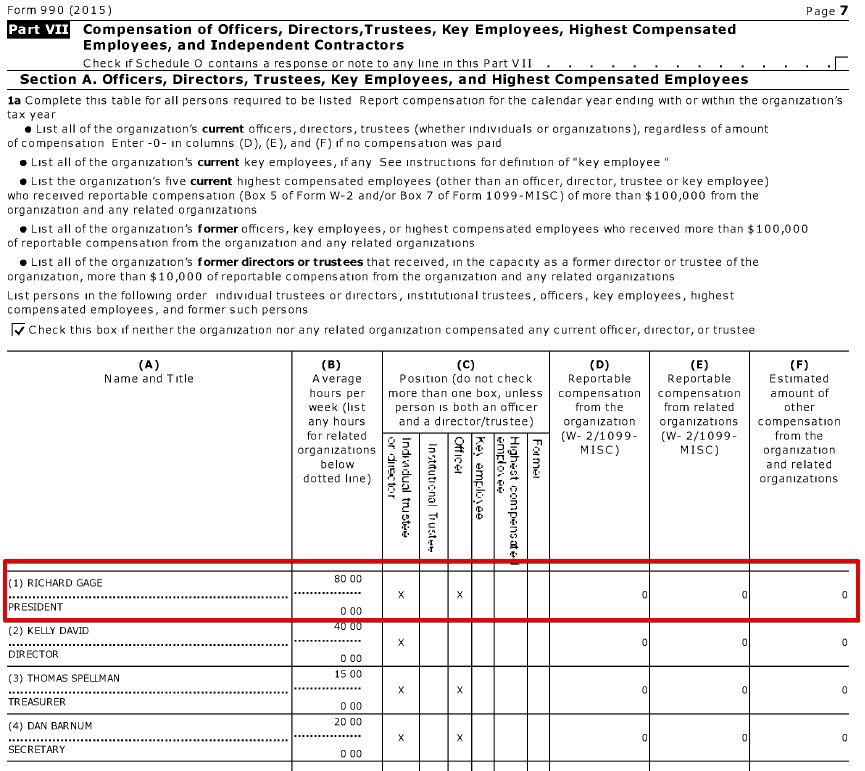

Someone asked if Richard Gage (head of Architects and Engineers for 9/11 Truth - AE911) has a profit motive for promoting one story over another. I remembered that the AE991 990 forms had listed his compensation, so I went to look it up. The most recent filing on Guidestar is for the 2015 tax year.

I was surprised that it was listed as 0, even though he was working for 80 hours a week. as I remembered it being higher. I looked at the previous year, 2014:

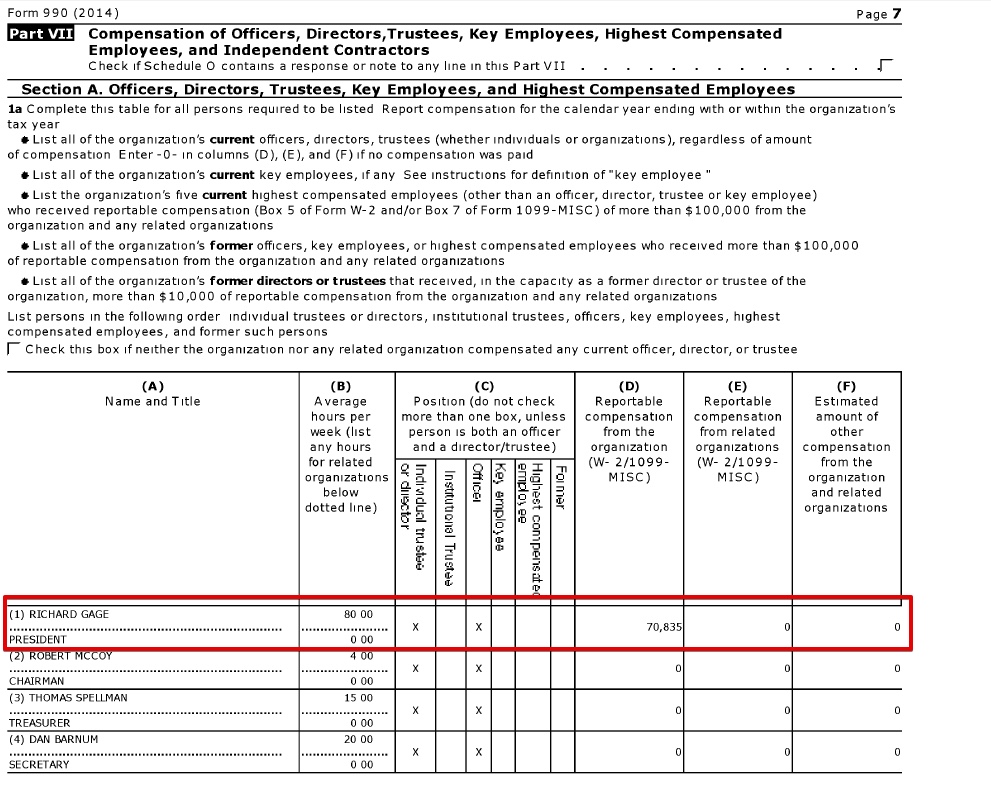

Sure enough $70,835, wh

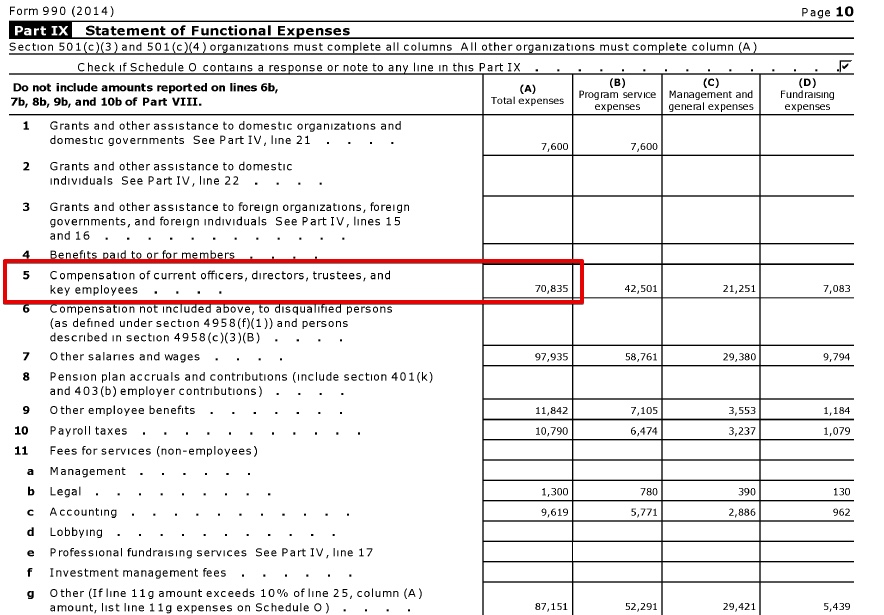

This amount is also listed in the 2014 990 on pages 8 and 10:

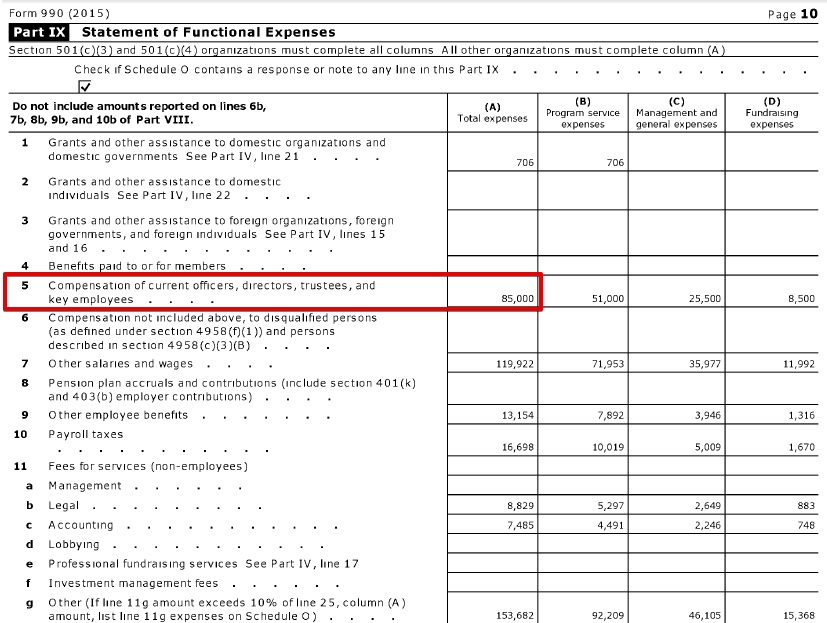

So we'd expect that line to also be zero on the 2015 form? But it isn't:

Of course there's nothing wrong with the president of a non-profit taking a salary. However it would seem like this should be made clear. In 2015 there was $234,774 in "Salaries and other compensation", and yet no indication of where this was going.

Presumably Gage is at least being paid $85K, but why is this no longer being reported? Has the tax code changed?

Source of of 990 Forms:

2007-2013 = https://www.citizenaudit.org/organization/261532493/architects-engineers-for-911/

2014/2015 = https://www.guidestar.org/profile/26-1532493

2016 = Direct request from AE911Truth

I was surprised that it was listed as 0, even though he was working for 80 hours a week. as I remembered it being higher. I looked at the previous year, 2014:

Sure enough $70,835, wh

This amount is also listed in the 2014 990 on pages 8 and 10:

So we'd expect that line to also be zero on the 2015 form? But it isn't:

Of course there's nothing wrong with the president of a non-profit taking a salary. However it would seem like this should be made clear. In 2015 there was $234,774 in "Salaries and other compensation", and yet no indication of where this was going.

Presumably Gage is at least being paid $85K, but why is this no longer being reported? Has the tax code changed?

Source of of 990 Forms:

2007-2013 = https://www.citizenaudit.org/organization/261532493/architects-engineers-for-911/

2014/2015 = https://www.guidestar.org/profile/26-1532493

2016 = Direct request from AE911Truth

Attachments

-

2015-261532493-0d9038c1-9.pdf1.2 MB · Views: 899

-

2014-261532493-0c497ecf-9.pdf1.3 MB · Views: 867

-

2012 AE911 Tax Return - 26-1532493_990_201212.pdf1.1 MB · Views: 891

-

2013 26-1532493_990_201312.pdf1.7 MB · Views: 804

-

2007 26-1532493_990EZ_200712.pdf760.4 KB · Views: 750

-

2008 26-1532493_990EZ_200812.pdf552.3 KB · Views: 713

-

2009 26-1532493_990EZ_200912.pdf743.3 KB · Views: 876

-

2010 26-1532493_990_201012.pdf1.4 MB · Views: 847

-

2011 26-1532493_990_201112.pdf1.4 MB · Views: 820

Last edited: